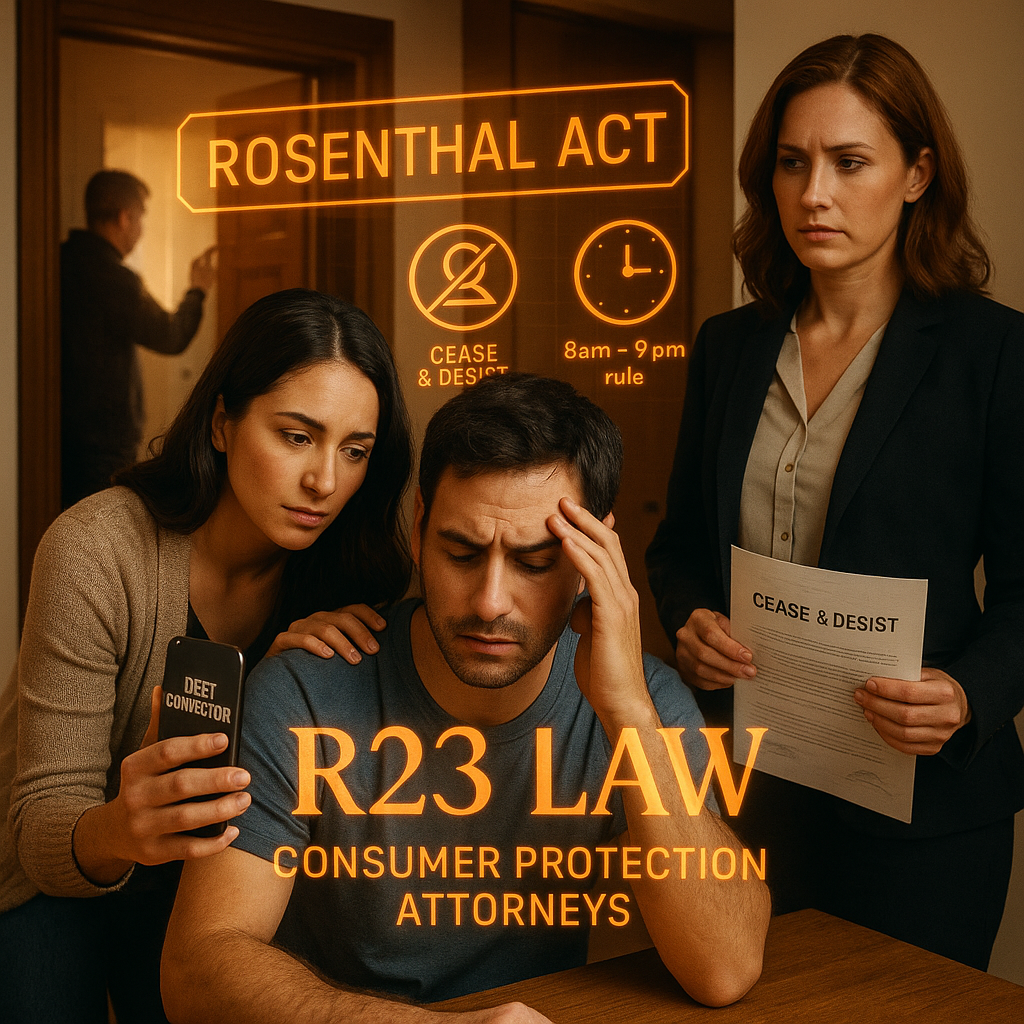

CALIFORNIA DEBT COLLECTORS CROSSED THE LINE — The Rosenthal Act Lets You Fight Back

You don’t lose your dignity just because you fall behind on a bill

Whether you’ve dealt with job loss, a medical emergency, or life simply got in the way—debt happens. But what should never happen is being harassed, threatened, or intimidated by debt collectors.

Under the Rosenthal Fair Debt Collection Practices Act, California gives you powerful rights to stop debt collection abuse. At R23 Law, our California Consumer Protection Lawyers know how to hold creditors and collection agencies accountable—and make them pay for crossing the line.

Debt Doesn’t Erase Your Rights

Debt collectors often rely on scare tactics and shame to get results. But here’s the truth: owing money doesn’t give them the right to mistreat you.

The federal Fair Debt Collection Practices Act (FDCPA) protects all U.S. consumers. In California, the Rosenthal Act goes even further—extending protections to include original creditors, not just third-party debt collectors.

Whether you're being hounded by a collection agency or directly by a bank, you are still protected.

Illegal Collection Tactics Banned Under California’s Rosenthal Act

Both the FDCPA and Rosenthal Act prohibit collectors from using abusive, deceptive, or unfair practices. If any of the following sound familiar, you may have a legal claim:

Calling you before 8 a.m. or after 9 p.m.

Calling you at work after you’ve asked them not to

Harassing or threatening you with arrest or legal action

Lying about the debt or their identity

Ignoring your written request to stop contacting you

Contacting friends, family, or coworkers about your debt

Using obscene language or abusive tone

Publishing your name on a “debtors list”

Demanding more than you owe, or adding illegal interest and fees

These behaviors aren’t just unethical—they’re illegal.

Know Your Legal Power Under the Rosenthal Act

Even if you do owe the debt, the collector must:

Provide written proof of the debt upon request

Cease contact if you send a cease and desist letter

Stop reporting the debt if you dispute it and they can't verify it

If they fail to do any of the above, you may be entitled to:

Up to $1,000 in statutory damages

Actual damages for stress, lost wages, or reputational harm

Attorney’s fees—you don’t pay unless we win

R23 Law Stops Harassment—and Makes Them Pay for It

If you’re being harassed about a debt in California, R23 Law’s Consumer Protection Attorneys will take swift legal action to:

Stop the calls, threats, and intimidation immediately

File claims under both state and federal law

Recover damages and force collectors to pay penalties

We’ve helped countless Californians regain control of their lives—and their peace of mind—by standing up to unlawful debt collection practices.

Take Action Today with R23 Law

You do not have to tolerate harassment, no matter your financial situation. If collectors are violating the Rosenthal Act, they’re on the wrong side of the law—and you have the right to make them pay for it.

📞 Contact us online for a free consultation with an R23 Law California Consumer Protection Attorney. We’ll review your case and help you take the next step—no pressure, just real legal support.