CREDIT CHAOS IN SOMEONE ELSE’S NAME — How Identity Theft Wreaks Havoc on Your File

When Credit Problems Aren’t Yours—But the Consequences Are

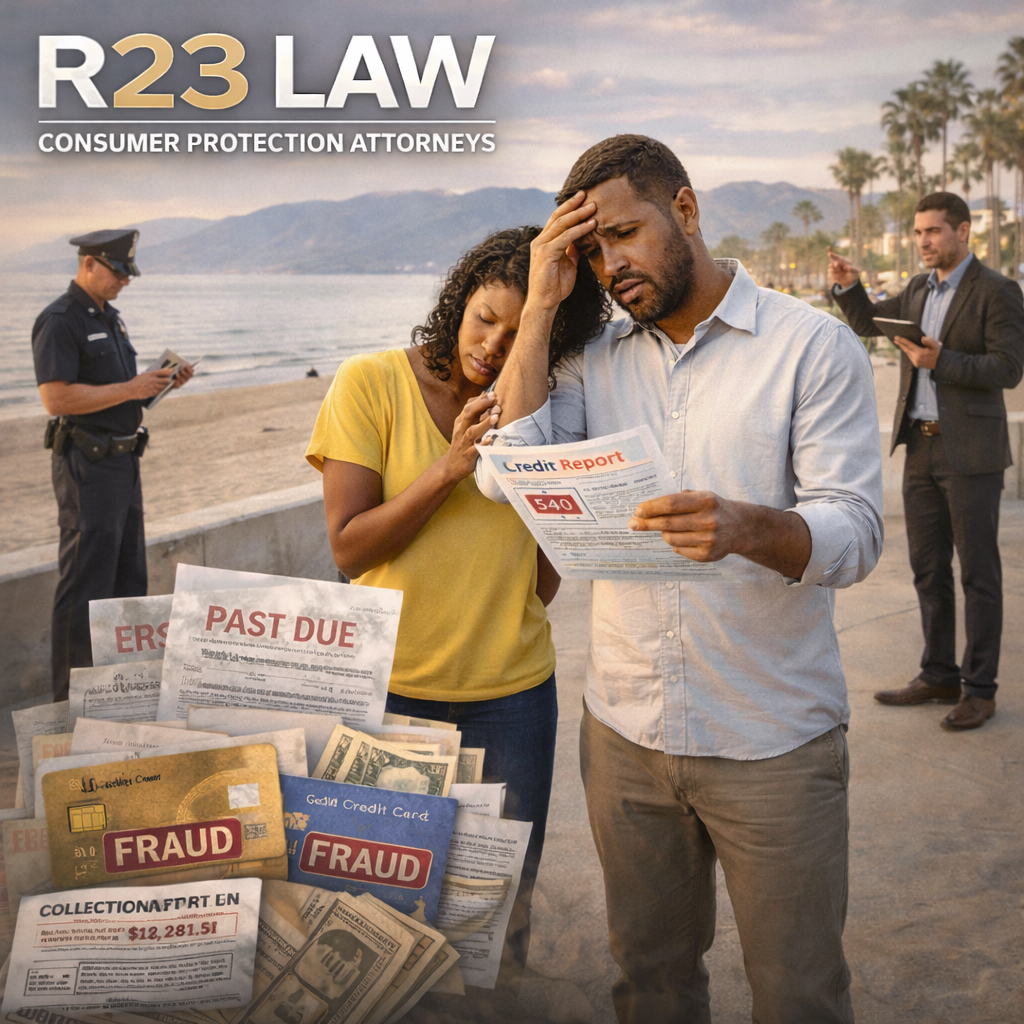

You’ve been careful with your finances. But one day, you’re denied a loan, see an unfamiliar account, or get harassed by a collector for a debt you never owed. Welcome to the aftermath of identity theft.

At R23 Law, our California Identity Theft Victim Lawyers help clients across the state reclaim their names and clear their credit files when unauthorized activity causes long-term financial harm. We know it’s not just about fixing a credit report—it’s about restoring peace of mind.

How Identity Theft Starts—and Why It Escalates

Identity theft doesn’t always begin with a major data breach. Sometimes all it takes is:

A stolen wallet

A compromised phone

A hacked email

A leaked account password

Thieves use your personal information to:

Open fraudulent credit cards

Rack up unauthorized charges

Apply for loans or lines of credit

Submit false applications in your name

Victims often discover the problem too late—after their score has dropped or they’ve been denied something essential.

The Credit Damage Is Real—and It Gets Worse with Time

If identity theft isn’t stopped quickly, it can lead to:

Missed payments and default notices

Lower credit scores that affect every part of life

Rejected applications for cars, homes, or business funding

Harassment from debt collectors about accounts you never opened

Legal action like wage garnishment or lawsuits

Even when victims act fast, the recovery process is often slow, confusing, and frustrating.

Why Documentation Is the Key to Clearing Your Name

To repair the damage, you’ll need evidence—lots of it. That includes:

Bank or credit card statements showing your actual usage

Letters from debt collectors that list fraudulent accounts

Copies of identity theft affidavits

Police reports documenting the crime

Any correspondence with credit bureaus or creditors

This kind of paper trail helps attorneys challenge incorrect credit entries and stop collection actions in their tracks.

How R23 Law Helps Identity Theft Victims in California

R23 Law Consumer Protection Attorneys doesn’t just write dispute letters—we build full legal cases to:

Force correction of false credit listings

Shut down collection efforts for stolen debts

Hold creditors and credit bureaus accountable

Recover compensation where laws like the FCRA and California identity theft statutes have been violated

Our attorneys work with you step by step to gather the right documentation, pursue legal remedies, and resolve the issue for good.

📞 Toll-Free: 310-598-1588

📱 SoCal Office: (310) 598-1588

📧 Email: info@R23Law.com

🔗 Contact Us

R23 Law Consumer Protection Attorneys — Standing Up for the Wrongfully Accused, One Credit Report at a Time

You didn’t create the debt. You shouldn’t have to carry the burden. Let R23 Law fight for your name—and your future.