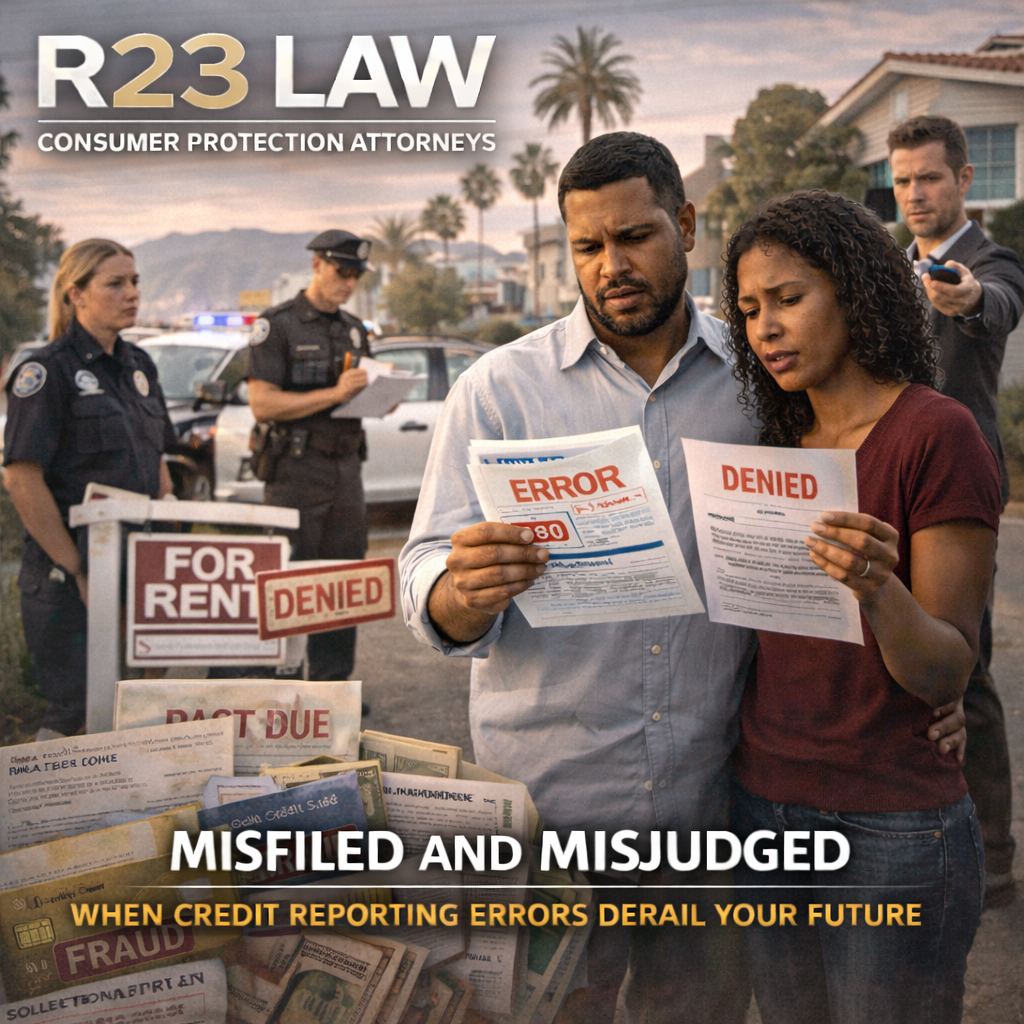

MISFILED AND MISJUDGED — When Credit Reporting Errors Derail Your Future

Errors on Your Credit Report Can Cost You More Than a Loan—They Can Cost You Peace of Mind

If you've ever been denied for a credit card, loan, or rental and had no idea why, your credit report might be to blame. But not because of your financial habits—because of someone else’s mistake.

At R23 Law, our California Consumer Protection Attorneys help clients across the state identify and correct credit reporting inaccuracies. We know how a single error can create a ripple effect—and we know how to fight back when the system fails to fix it.

Common Causes of Credit Report Errors

Mistakes on your credit report can stem from:

Incomplete or Outdated Information

Closed or paid-off debts still showing as open or unpaid

Unauthorized Accounts

Often due to identity theft—accounts you didn’t open in your name

Misapplied Payments

Payments you made on time are marked late, increasing your balance

Data Entry Errors

Transposed digits, mixed-up names, or incorrect Social Security numbers can link your profile to someone else’s file

These errors can instantly drop your credit score and leave you struggling to qualify for financing or employment.

Why These Mistakes Matter

The consequences are serious:

Higher interest rates on loans and credit cards

Rejections for housing or employment

Collection calls for debts you don’t owe

Long-term credit damage that affects your financial reputation

Even worse, some credit bureaus or lenders ignore valid disputes—leaving you stuck with errors that keep showing up.

You Have Rights—and We Make Sure They’re Enforced

Under the Fair Credit Reporting Act (FCRA), you have the right to:

Dispute false or misleading credit data

Receive a timely investigation (within 30 days)

Demand correction or deletion of inaccurate information

Sue for damages if these rights are ignored

At R23 Law Consumer Protection Attorneys, we don’t just send letters. We build legal cases to ensure agencies and creditors take your dispute seriously—and compensate you when they don’t.

How R23 Law Helps with Credit Disputes

Our legal team helps clients across California by:

Reviewing credit reports for false or outdated items

Gathering key documentation (ID theft affidavits, billing statements, dispute letters)

Submitting disputes to bureaus and following up when ignored

Filing formal complaints or lawsuits if needed

Whether your dispute involves a reporting agency, a lender, or both, we’re ready to help you take control of your credit file.

📱 SoCal: (310) 598-1588

📧 Email: info@R23Law.com

🔗 Contact Us

R23 Law — Legal Backup for Californians Fighting Credit Injustice

A typo shouldn’t define your financial future. We’re here to fix the record—and defend your rights every step of the way.