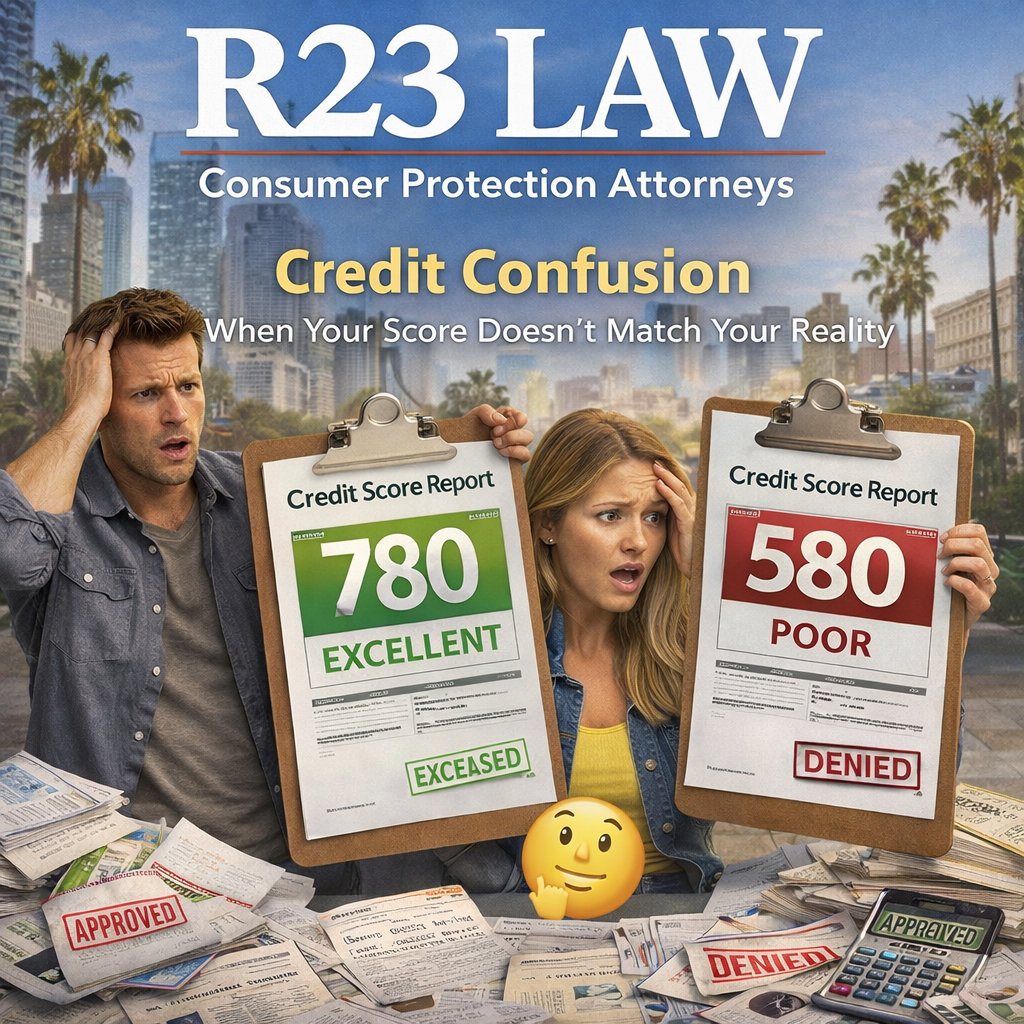

CREDIT CONFUSION — When Your Score Doesn’t Match Your Reality

Credit Scores Aren’t Always Right — And That’s a Problem

Your FICO score can decide whether you get a credit card, lease an apartment, or secure a mortgage. But what if that score is wrong? For thousands of Californians, incorrect credit reports mean lost opportunities, denied applications, and financial chaos — all because of errors you didn’t create.

At R23 Law, our California Consumer Protection Attorneys represent clients statewide in disputes with credit bureaus and data furnishers. When your score doesn’t reflect your real financial history, legal action may be your strongest move.

What Is a FICO Credit Score?

The FICO score — developed by the Fair Isaac Corporation — is a widely used measure of creditworthiness. It’s calculated based on five main categories:

Payment history (35%)

Amounts owed (30%)

Length of credit history (15%)

Types of credit used (10%)

New credit inquiries (10%)

But here’s the catch — the exact formula is proprietary, and each of the three major credit reporting agencies (Experian, Equifax, and TransUnion) may interpret and plug data into that formula differently.

Why Credit Scores Go Wrong

According to the document, credit scores often misfire due to:

Mismatched or outdated information

Reporting delays from creditors

Identity mix-ups or merged files

System errors from the credit bureaus

Faulty manual data entry during credit reporting

What seems like a small mistake on paper — a missed payment you never missed, an account you never opened — can spiral into a credit disaster.

What If My Credit Score Is Inaccurate?

If your credit score appears lower than expected, start with these steps:

Request your credit report from all three bureaus (you can do this for free annually at AnnualCreditReport.com).

Check for errors — look for duplicate accounts, outdated info, or debt you don’t recognize.

File a dispute directly with the bureau(s) reporting inaccurate information.

Document everything — include letters, account statements, and payment history.

By law, bureaus must investigate disputes within 30 days — but as many consumers have discovered, the process is rarely smooth.

The Real Cost of Credit Errors

Credit reporting mistakes can impact:

Auto loan approvals

Mortgage rates and eligibility

Credit card applications

Employment background checks

Rental housing opportunities

You can lose more than money — you lose access, time, and trust.

When to Bring in a Legal Team

If your credit dispute has been ignored, mishandled, or denied without justification, it may be time to escalate.

R23 Law’s California Consumer Protection Attorneys regularly represent clients in disputes against:

Credit reporting agencies (Experian, Equifax, TransUnion)

Lenders and furnishers who report incorrect data

Debt collectors submitting false information

Our legal strategies include enforcing your rights under the Fair Credit Reporting Act (FCRA) and demanding correction, compensation, and accountability.

Contact R23 Law Today

📱 SoCal: (310) 598-1588

📧 Email: info@R23Law.com

📂 Contact Us for a Free Case Review

Learn more about our Attorneys and Consumer Protection Practice