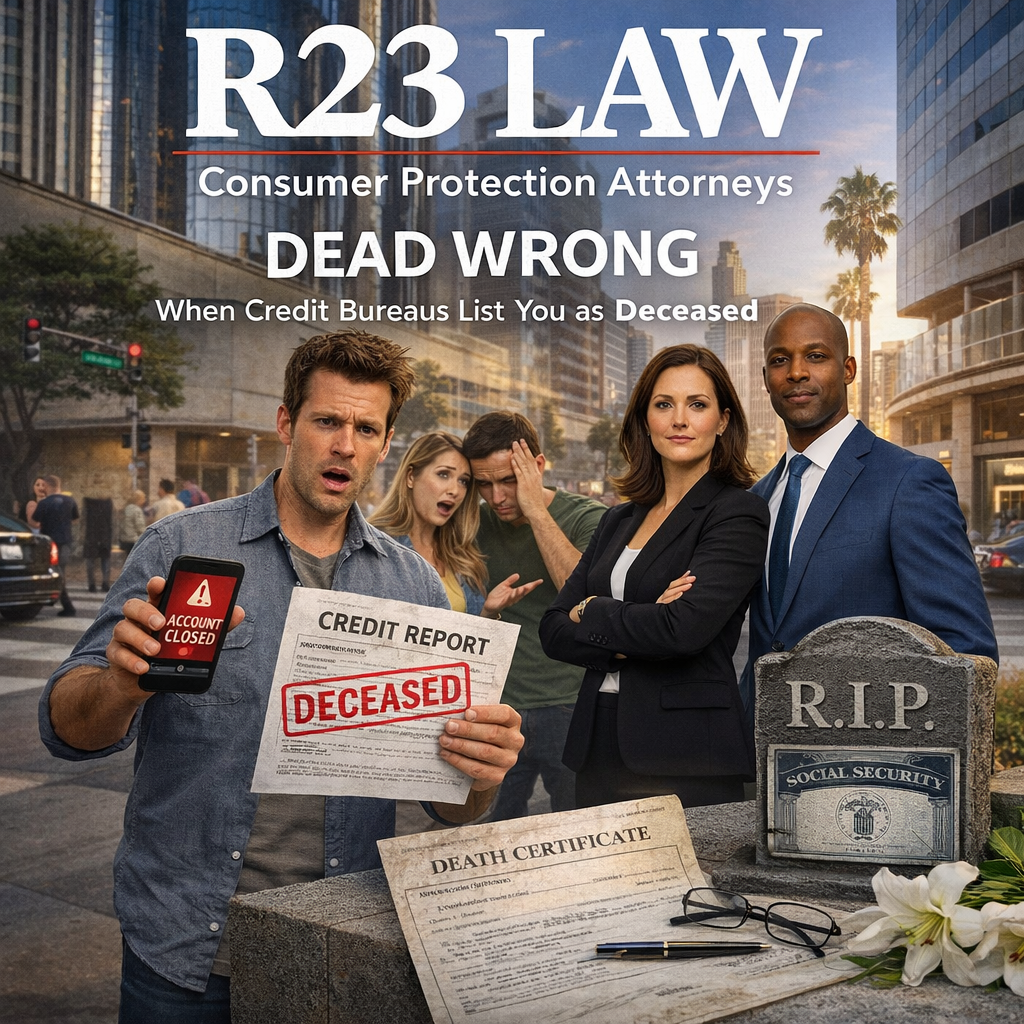

DEAD WRONG — When Credit Bureaus List You as Deceased

You’re Not Dead — But Your Credit Report Thinks You Are

Imagine applying for a mortgage or car loan — only to be denied because the credit bureau has declared you… deceased. This isn’t a dark joke. It’s a real and disturbing credit reporting error affecting thousands of living consumers each year.

At R23 Law, our California Consumer Protection Attorneys work with clients who have been wrongfully flagged as deceased by major credit bureaus like Experian, Equifax, or TransUnion. This kind of error doesn’t just impact your credit — it can affect your ability to live your life.

How Does This Happen?

Credit reporting agencies don’t create credit files from scratch — they pull data from a wide range of sources, including:

Credit card issuers

Banks

Service providers

Public death records

Social Security Administration data

Errors often occur when:

A co-signer dies, and their data is mistakenly linked to your profile

You share a similar name or birthdate with a deceased person

There is a data entry error in a bank or lender’s system

Your file gets mixed with someone else’s — a surprisingly common issue known as a “merged file”

These mistakes can trick the system into thinking you’ve passed away — freezing your credit and shutting down your financial access.

What Are the Consequences?

Being misreported as deceased can be devastating. Common consequences include:

Denial of loans, mortgages, or rental applications

Rejected credit card applications

Loss of access to utilities or insurance

Emotional stress and reputational harm

Inability to co-sign or open joint accounts

Delays in employment background checks

Some consumers only find out they’ve been marked as dead when they're suddenly locked out of their credit or denied a transaction.

Can You Get Compensation for This Mistake?

Yes — under the Fair Credit Reporting Act (FCRA), you have the right to accurate and fair reporting. If a credit bureau lists you as deceased and it causes harm, you may be entitled to compensation for:

Emotional distress

Loss of credit opportunities

Lost time and wages

Out-of-pocket expenses

Legal fees

R23 Law’s California Consumer Protection Attorneys have helped clients hold credit bureaus accountable for errors that resulted in significant personal and financial harm.

What to Do If You’re Marked as Deceased

Request your credit report from all three bureaus: Equifax, Experian, and TransUnion.

Dispute the error in writing — don’t rely solely on online portals.

Gather documents proving your identity (ID, Social Security card, utility bill, etc.).

Contact a consumer protection attorney if the bureaus fail to correct the error or if you suffer damages.

Most importantly, act quickly — being listed as deceased can spiral quickly into financial disruption.

Contact R23 Law Today

📞 Toll-Free: 310-598-1588

📧 Email: info@R23Law.com

Free Consultation Request

Learn more about our Attorneys and Consumer Protection Practice