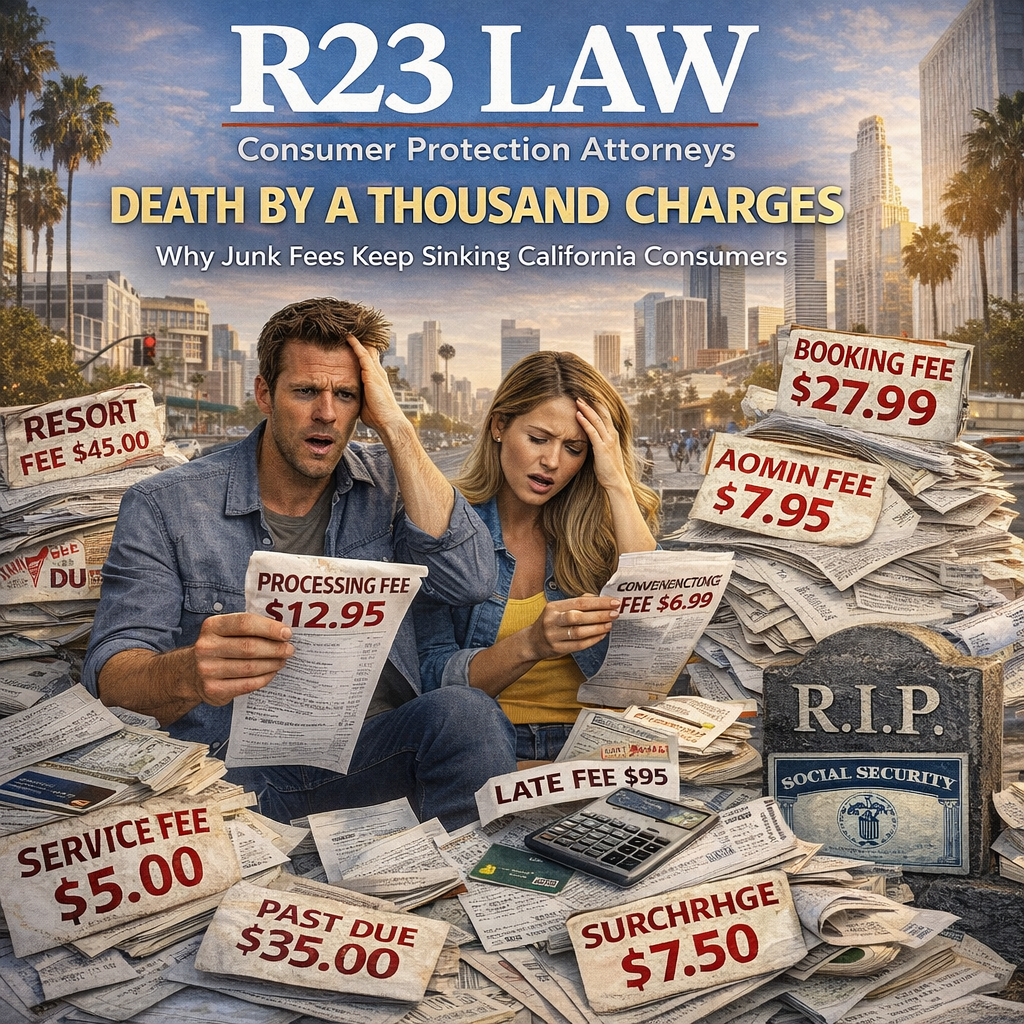

DEATH BY A THOUSAND CHARGES — Why Junk Fees Keep Sinking California Consumers

The Hidden Price of Fine Print

That hotel stay, concert ticket, or subscription deal may look affordable — until you get to the checkout screen. Suddenly, you’re paying extra fees for booking, processing, convenience, service, or other invented charges. These so-called “junk fees” are everywhere — and they’re quietly draining the wallets of Californians every day.

At R23 Law, our California Consumer Protection Attorneys are seeing more clients impacted by unfair, misleading, and often undisclosed junk fees in everything from streaming services to housing leases.

What Are Junk Fees?

Junk fees are hidden or unexpected charges tacked onto a price after a product or service is advertised. These include:

Hotel “resort” fees

Rental application processing fees

Airline seat selection charges

Convenience fees for online payments

Unexplained service surcharges

These fees often show up only at the final step of a transaction, making it nearly impossible to compare true prices before purchase.

Why Junk Fees Hurt Consumers

They make it harder to budget — The final price you pay can be significantly higher than what you planned for.

They create false competition — Companies can appear cheaper than competitors, only to raise the cost at checkout.

They can lead to credit trouble — If a junk fee pushes a bill beyond your balance, you might miss a payment, triggering credit damage.

And perhaps most importantly, they’re often non-negotiable and buried in fine print.

Are Junk Fees Legal?

Currently, there is no federal or California law outright banning junk fees, but legislative efforts are gaining traction. In the meantime, consumers are left to fend for themselves against pricing games that cost billions nationwide.

However, there are still protections in place:

The Truth in Lending Act and California Unfair Competition Law can apply if a fee is misleading or unfair.

Failure to disclose mandatory fees may give you grounds to challenge the transaction or seek legal remedies.

If you were charged a fee you didn’t authorize or weren’t clearly informed about, you may have a case.

How to Protect Yourself from Junk Fees

Always read the fine print — Especially in contracts, rental agreements, or recurring subscriptions.

Request itemized receipts — Understand exactly what you’re being charged for.

Compare total prices, not just advertised ones — Some companies use low base prices to draw you in, then pile on fees.

Ask questions — If a charge seems unclear, request written clarification.

Keep records — Save screenshots and emails showing price changes or unclear fees.

If the charge is not what you agreed to, or if you discover fees after the fact, you may be able to dispute them.

When to Call a Consumer Protection Attorney

You should consider contacting R23 Law if you’ve experienced:

Surprise fees in contracts or digital transactions

Fees that were added after a purchase was confirmed

Refusal to refund fees you never agreed to

Credit issues triggered by unexpected or excessive charges

Our team of R23 Law California Consumer Protection Attorneys regularly represents clients in unfair fee cases under both state and federal law — including against banks, landlords, ticket platforms, and online service providers.

Contact R23 Law Today

📞 Toll-Free: 310-598-1588

📧 Email: info@R23Law.com

🗂️ Request a Free Consultation

📚 Learn more about Our Team and Consumer Right