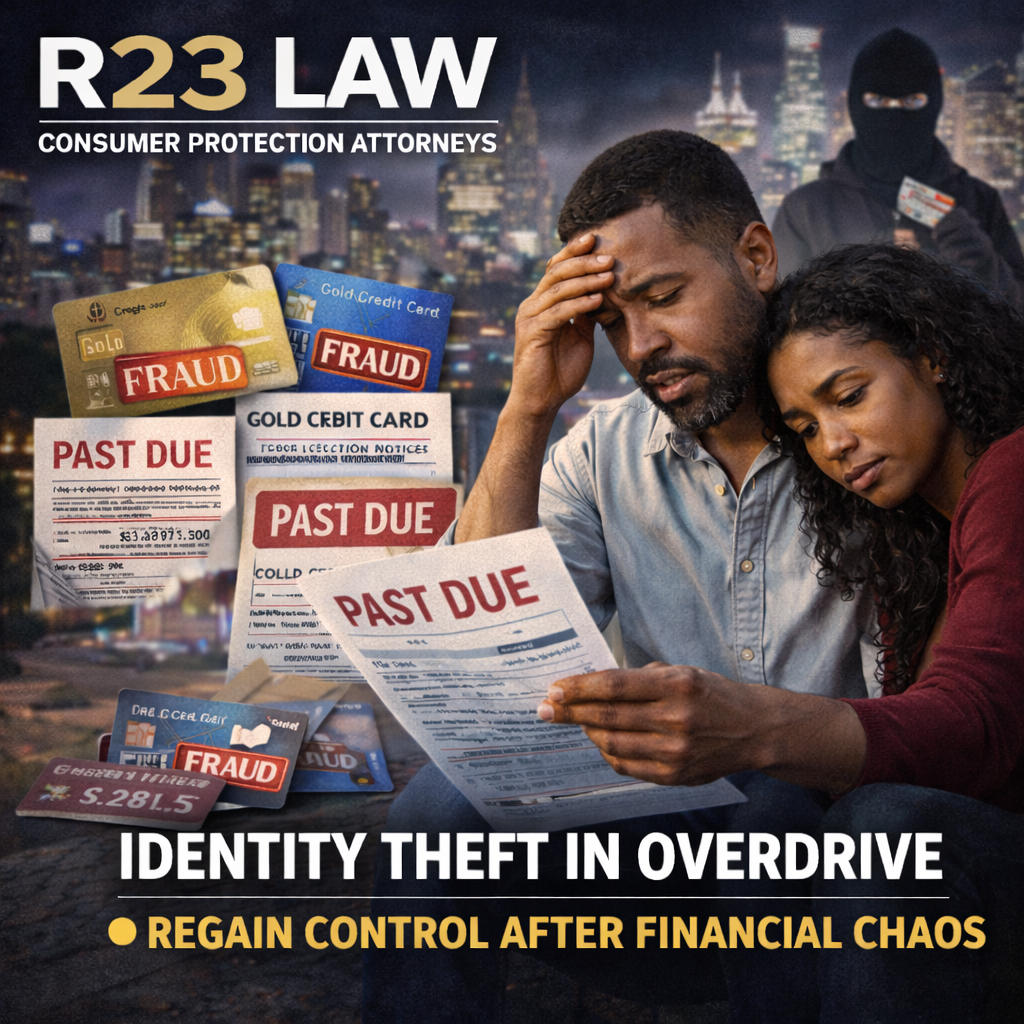

IDENTITY THEFT IN OVERDRIVE — When One Fraudulent Charge Spirals Into Financial Chaos

In a City Like Los Angeles, Identity Theft Doesn’t Just Hurt—It Multiplies

In a fast-paced city like Los Angeles, identity theft can start small and explode fast. A single unauthorized transaction can evolve into a full-blown financial crisis—leaving victims stuck with fraudulent credit lines, damaged reports, and emotional exhaustion.

At R23 Law, we help victims in California fight back when identity theft causes more than inconvenience. Our R23 Law California Identity Theft Victim Lawyers know how to cut through the confusion and restore your financial life.

The Domino Effect of Identity Theft

Most people don’t know they’ve been targeted until something major happens:

They’re denied a credit card or home loan

Debt collectors start calling

They spot suspicious accounts on their credit report

Their score tanks—and they don’t know why

Fraudsters may open multiple accounts or rack up thousands in unauthorized charges. The longer the theft goes undetected, the worse the damage becomes.

And the reality? Filing a police report or calling your credit card company is often not enough. You’ll likely be stuck dealing with:

Multiple lenders

Three different credit bureaus

Debt collectors

A maze of paperwork and legal deadlines

Without legal help, it’s easy to feel overwhelmed.

Credit Reporting Agencies Don’t Always Do Their Job

Even if you prove the fraud, credit reporting agencies like Equifax, Experian, and TransUnion often fail to remove false information quickly—or at all.

These unresolved issues can:

Delay your ability to rent an apartment

Derail a job application

Hurt your ability to get a mortgage or car loan

Leave you responsible for debts that aren’t yours

The Fair Credit Reporting Act (FCRA) gives you rights—but when those rights are violated, R23 Law steps in to enforce them.

We Help Clients Across California Take Back Control

At R23 Law, we use a legal-first strategy to handle identity theft cases. That means:

Disputing errors with all relevant credit bureaus

Filing formal complaints with creditors

Documenting every fraudulent account or transaction

Pursuing compensation where applicable

Our goal is to help you restore your financial standing—and hold the responsible parties accountable.

📱 SoCal: (310) 598-1588

📧 Email: info@R23Law.com

🔗 Contact Us

R23 Law Consumer Protection Attorneys — Repairing the Damage.

Restoring Your Reputation.

You didn’t ask for this crime—but you don’t have to live with the consequences. Let our attorneys help you rebuild what identity theft tried to destroy.